Investor participation is at an all-time high

The stock market has enticed more people than ever to start a portfolio and invest more. There are many reasons why investors are piling money into the markets. The pandemic and stay-at-home mandates simply gave people more time to get involved. Corresponding stimulus checks added more cashflow for some investors to use. Media headlines seem to cover overnight success stories on a daily basis.

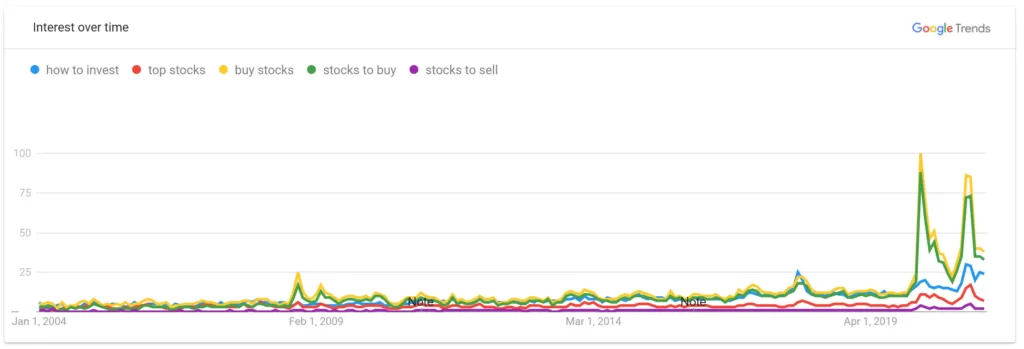

Whatever the reasons, it’s clear that investors are putting down money and betting on the stock market. Just take a look at the past couple decades of Google search trends.

New brokerages have entered the race

Online discount brokerages began opening their doors in the 90s and early 2000s. This introduced an easier way for casual investors to manage their own investments. And many services enticed customers by lowering their trade commission fees. Fast forward to 2013 and the popular trading app Robinhood launched.

You can call it the “Robinhood Effect” or the “Race to Zero” but stock brokerages started lowering their prices until many decided to simply ditch the fees and go commission-free. Today it’s almost a surprise when you hear that a brokerage charges a fee for trading stocks.

Long gone are the days were you paid $6.95 per trade. Mobile applications are quick and easy. Online bank transfers are simple. Many brokerages are now offering stock charts and portfolio trackers they used to sell as premium monthly subscriptions.

Data is literally at our fingertips. The power that individual investors have over their financial portfolios has never been better.

Now brokers are paying you to use their services

It certainly sounds like a joke or something too good to be true, but ironically brokerages have gone from charging their users commission fees to paying their users a commission of sorts just to use their service.

Brokers are now handing out free stock!

The criteria for receiving free stocks vary from broker to broker. Some give stocks to investors who simply open an account, while others have specific criteria such as depositing funds or maintaining a certain funding level for a time period. And then others simply award you with cash in your account.

You certainly won’t get rich overnight by signing up and getting a free stock, but many of these offers vary in value. The splashy headlines on many of their marketing landing pages flash big numbers like $500 up to $2,000 per stock. But the odds are generally lower for receiving a higher valued stock. Most basic stocks received in these promotions are valued around $2–10. You can read the promotional terms to see the odds of receiving anything greater. In our research, we signed up for a dozen different brokers and our average free stock value was about $10.

But wait… there’s more!

It’s the classic marketing hook to keep you interested and get you to spend even more. But in this case, it’s actually another potential bonus you get when signing up for these promotional offers.

Nearly every online broker offers some sort of referral or affiliate program. It’s simple… you send out a personalized referral link to a friend, they sign up, and you both receive a free stock. The offers and rewards vary, but the sharing mechanism is simple. You log into the broker’s online website or mobile app and look for a referral tab. You’ll see a custom sharing link unique to you. Some providers are even happy to pay $50 or more for every new customer you sign up, so it’s worth opening your contact list on your phone for a few minutes!

Why do brokerages hand out free stock?

Because one competitor started doing it so they feel pressured to maintain a similar incentive. Because it’s a catchy marketing campaign. But mostly because it’s actually a very inexpensive customer acquisition strategy.

Every company keeps track of how much money it costs to get a new customer in the door. Then they track how much money that customer generates for their bottom line over the next few years. The business lingo for all this is “customer acquisition cost” and “lifetime customer value.”

It might seem expensive to “give away” free stock, but let’s look at some recent promotional terms to see what the odds are to receive higher valued stocks.

| Odds | Stock Value |

|---|---|

| 98% chance | $3–$10 |

| ~1% chance | $10–$50 |

| ~1% chance | $50–$200 |

For the sake of making it simple math, let’s suppose that 100 people sign up and qualify for each of the company’s promotions listed in the tables above. Here’s a rough estimate of how many people would win and what it might cost each company to run their campaigns.

| Customers | Stock Value | Low End Estimates | High End Estimates |

|---|---|---|---|

| 98 | $3–$10 | 98 x $3 = $294 | 98 x $10 = $980 |

| 1 | $10–$50 | 1 x $10 = $10 | 1 x $50 = $50 |

| 1 | $50–$200 | 1 x $50 = $50 | 1 x $200 = $200 |

| $354 combined value | $1,230 combined value |

That means if the broker were to award the lowest valued stocks for each new customer, the broker would only send out $354 in free stock to 100 new customers. That’s an average “cost per acquisition” for each new customer of $3.54.

Or if the broker were to award the highest valued stock for each new customer, the broker would send out $1,230 in free stock to 100 new customers. That would be a higher customer acquisition cost of $12.30 for each new customer.

Now of course this is simplified math. The broker has many other costs involved in running a promotion and servicing the needs of their customers. The stocks are awarded over an extended time period and of course stock prices fluctuate, which means the prize values would fluctuate even if 2 customers received the same stock.

But the tables above serve the purpose of showing that in this example, the broker is only paying out between $3.54–$12.30 for each new customer. In a world where Super Bowl commercials cost $5,000,000+ and social media influencers can make $50,000 per social post, the costs behind a free stock promotion appear to be a very attractive campaign to any company!

What’s the fine print?

Carefully read each of the promotional terms before signing up.

Some brokers simply require you to sign up for a free account to receive a free stock. Other brokers charge a monthly fee (typically a small fee of $1–5 per month) to use their service and qualify for the free stock promotion.

Some brokers have rules about minimum funding amounts. You might have to fund $100 from your connected bank account before you can receive your free stock.

And then some brokers have rules about the minimum time required to leave the initial funds in your account. You might have to keep your initial $100 investment in your account for a period of 3 months or longer to qualify for your free stock reward.

Free stocks for just a few minutes of work

Even with all the fine print around each of the current free stock promotions, it’s hard to deny that these are really good offers. It takes just a few minutes to open a new account. Create a username and password, fill out a few government required questions and you’re on your way to earning a free stock.

That free stock might be worth $5 or it might be worth $500. But even if you open a new account that requires an initial $100 deposit and you receive a stock valued on the lower end around $8, you just earned 8% on your investment. There aren’t many savings accounts out there that can match that type of reward! And if you hold on to that free stock, there’s a possibility that it will gain even more value with time.

Be smart. Investing can be risky.

You probably expected some sort of disclaimer, and we do have a longer disclaimer here. But it’s important to note that investing in securities (such as stocks or options) involves risk, including the possible loss of principal (your initial deposit), and there is no guarantee that any investment will achieve its objectives, generate profits, or avoid losses. In other words, you could deposit $100 and earn a free stock worth $10. But that $110 could evaporate overnight in a sudden collapse of the markets. That’s an unlikely scenario, but before investing, consider your investment objectives.

This site does not provide investment, financial, tax or legal advice. We simply provide a list of current offers with free stock promotions you could earn. Always do your due diligence before signing agreements with any company or before using their services.

What are the current free stock promotions?

You can find all the latest promotions on our homepage at https://EarnFreeStocks.com